Have you come across the question, or maybe asked yourself, How can AI be used in financial planning? Ever thought a robot might manage your money better than you? Sounds wild, right? But that’s the cool thing about AI shaking up the world of financial planning! AI isn’t just for sci-fi movies anymore. It’s boosting things like decision-making, predicting market trends, and managing those tricky portfolios. Imagine having a futuristic tool that makes financial planning feel like a breeze while keeping your interests safe. Let’s geek out over how AI is helping financial advisors—and maybe even you—navigate the money maze with ease!

Understanding AI in Financial Planning

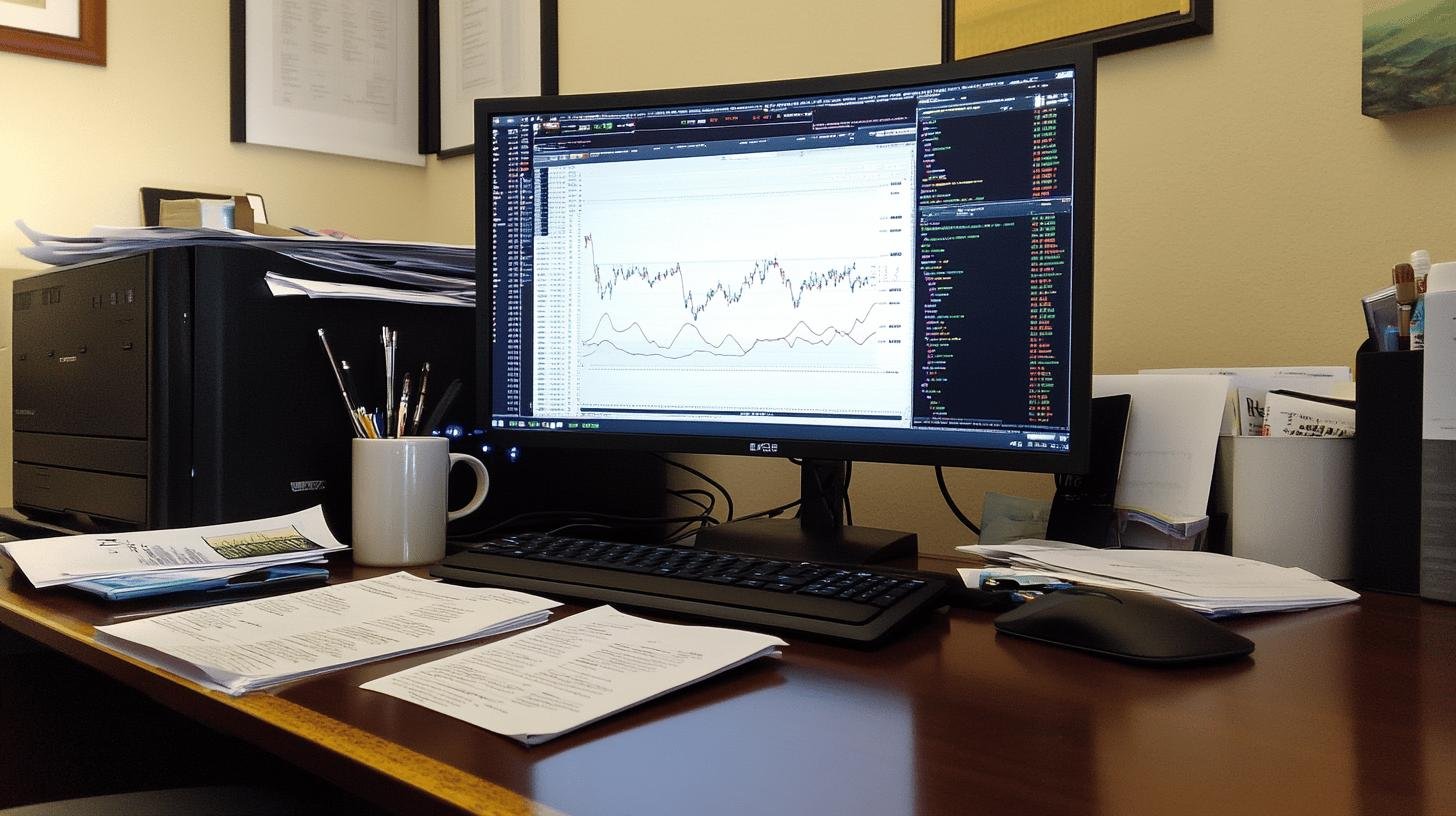

AI is changing the trajectory in financial planning. We all aim to make smarter money decisions, and AI, or artificial intelligence, acts as the ultimate helper in achieving that goal.

By leveraging machine learning (ML), where computers learn from data to enhance tasks over time, AI is enhancing financial management. It’s like having a nonstop, ultra-smart assistant by your side.

How can AI be used in financial planning, and why is that important?

AI is vital because it helps improve decision-making and manage portfolios efficiently. Imagine tracking stocks, bonds, and other investments effortlessly. AI quickly analyzes vast amounts of data, offering insights that might otherwise be overlooked.

1. Cool AI Technologies

Some impressive technologies include predictive analytics and robo-advisors. Predictive analytics forecasts market trends, reducing reliance on gut feelings. Robo-advisors provide personalized investment advice, often at a fraction of the cost of human advisors.

2. Key AI Applications in Finance

Here’s a closer look at some vital AI applications in finance:

- Predictive Analytics: Helps forecast market trends for informed investment decisions.

- Robo-Advisors: Offers automated, personalized investment advice.

- Portfolio Management: Optimizes strategies using real-time data.

Financial advisors must adopt AI responsibly, ensuring client interests are protected. It’s like having a wise guide through the financial landscape.

Key AI Technologies Transforming Financial Strategies

1. Robo-Advisors

Have you ever wondered how you can have a round-the-clock investment guru? Robo-advisors fit the bill. They provide personalized advice without the expensive fees. They act like a cost-effective financial planner, using algorithms to design investment strategies just for you. Plus, they give real-time updates, keeping your investments on track effortlessly.

2. Predictive Analytics

Want to stay ahead in investing? Predictive analytics is your go-to tool. It analyzes vast data to predict market trends, aiding informed decisions. Think of it as your investment weather report, advising when to shield or embrace financial opportunities. This tool refines your strategies, making financial planning safer and more precise.

3. Sentiment Analysis

Curious about market predictions? Sentiment analysis reveals the market’s mood. By assessing social media, news, and other data, it uncovers if the market is feeling upbeat or pessimistic. Understanding market behavior helps you adjust strategies. It’s like a mood ring for trading, guiding you through fluctuations.

Enhancing Decision-Making with AI in Finance

How does AI aid financial decision-making? It automates data analysis, enabling swift and accurate processing. Consider AI as an efficient data handler, identifying trends invisible to the human eye. By automating routine tasks, AI frees up time for strategic thinking.

Predictive analytics further enhances decision-making. Using AI to forecast market trends with historical data is like possessing a crystal ball, indicating when to buy or hold. This foresight is crucial for minimizing risks and making informed decisions.

Here are four ways AI improves financial decision-making:

- Automating Routine Tasks: AI handles data entry and report generation, allowing more time for analysis.

- Providing In-Depth Insights: It offers detailed analyses for sharper decision-making by revealing opportunities and risks.

- Enhancing Financial Assessments: AI evaluates financial health considering factors humans might overlook.

- Improving Goal Setting: AI analyzes past and present data to set realistic goals and adjust strategies.

AI in wealth management has the similitude to a reliable advisor crunching numbers and providing clear advice. Automated financial advice is more personalized, tailoring solutions to individual profiles, thus making planning precise and strategic.

AI Tools for Portfolio and Risk Management

How does AI optimize portfolios? It uses algorithms to analyze numerous data points, aligning strategies with your financial goals. These algorithms consider market trends, asset performance, and economic indicators, suggesting optimal investment mixes. They adjust strategies in real-time, maximizing returns and reducing risks—it’s like a team of experts at work round the clock.

In risk assessment, AI acts as a vigilant guard, scanning for potential risks and notifying you before problems arise. By analyzing past data and current conditions, AI forecasts risks, allowing proactive adjustments. It’s comparable to a weather forecast, preparing you for financial challenges.

AI tools in portfolio and risk management include:

- Portfolio Optimization Algorithms: Analyze investments and suggest asset allocations.

- Risk Management Systems: Continuously assess risks and offer mitigation insights.

- Real-Time Update Tools: Inform you of market changes, ensuring strategies are current.

AI-generated reports provide comprehensive yet actionable insights, enhancing strategic financial planning beyond guesswork.

Case Studies: AI in Action within Financial Planning

Case Study 1: Retirement Planning

Curious how AI eases retirement planning? Imagine a smart tool constantly fine-tuning your plan, adapting it to market shifts. AI does that! It evaluates savings, investments, and spending habits to ensure retirement readiness.

AI tools employ algorithms for simulating scenarios and guiding savings or investments. Think of these as a crystal ball for decisions. While great with numbers, AI might falter with unexpected events like health issues or economic changes. Nonetheless, AI helps proactive strategy adjustments.

Case Study 2: Financial Data Analysis

Now, let’s see how AI excels in data analysis. Picture a supercomputer processing heaps of data, spotting trends faster than a human. This means rapid insights and better investment calls.

AI-generated insights enable financial planners to understand market shifts and predict future trends. However, data quality remains crucial. Flawed or incomplete inputs can lead to misleading insights. Thus, while AI is a strong ally, data integrity is vital for accurate results.

Future Trends and Challenges in AI-Driven Financial Planning

1. Emerging Trends

How is AI altering financial planning’s future? It’s about merging AI with human judgment for smarter strategies. Though AI excels at data processing, human intuition is key for optimal decisions. Think of it as teamwork—AI handles data, while humans add personal insight.

The goal is to enhance human expertise with AI, not replace it. This hybrid model lets financial planners focus on personal advice instead of tedious calculations. It’s like a calculator doubling as a mentor!

2. Challenges and Regulatory Compliance

What challenges face AI in financial planning? Ethics and regulations are paramount. AI must adhere to standards, ensuring transparency, bias-freedom, and client priority. No rogue decisions without oversight should be allowed!

Regulatory compliance is also essential. Financial laws evolve alongside AI advancements, necessitating regular audits to ensure compliance with guidelines. It’s like a watchdog, maintaining fair play with a tech focus.

3. Future Trends in AI-Driven Financial Planning

Key future trends shaping finance include:

- Integration with Human Expertise: AI and humans collaborating for optimal outcomes.

- Evolution of Regulatory Compliance: New guidelines ensuring AI stays accountable.

- Ethical Consideration Advancements: Ensuring AI decisions are fair and transparent.

These trends highlight AI’s transformative journey in financial planning, blending tech savvy with human expertise.

Conclusion

We got right into AI’s impact on financial planning. It is clear how these technologies are shaking up the game. From helping advisors make smarter decisions to managing portfolios with ease, AI is here to play a starring role. Whether you’re updating your investment strategies or just curious about AI-driven tools like robot advisors, the potential is huge.

Looking ahead, balancing technology and human judgment remains key. Remember, understanding how AI can be used in financial planning can open up new opportunities for growth. Stay excited about the tech, and let’s see where it takes us!

FAQ

What are the key future trends in AI-driven financial planning?

AI is expected to advance in areas like predictive analytics, personalized financial advice, and real-time data processing, improving overall decision-making and efficiency.

How will AI improve accuracy in financial planning?

AI can reduce human error by using machine learning algorithms to analyze large datasets and generate more precise forecasts, helping individuals and businesses plan better financially.

What challenges do AI-driven financial planning systems face?

Challenges include data privacy concerns, regulatory compliance, ethical considerations, and the risk of over-reliance on automated systems without human oversight.